The big money has been on the other side - buying puts that other people are writing

so what you're browsing a giant list of puts for sale and picking some

or are you just saying "I'll buy any puts for this price on this date" and the market is big enough that some mad lad out there is guaranteed to sell to you

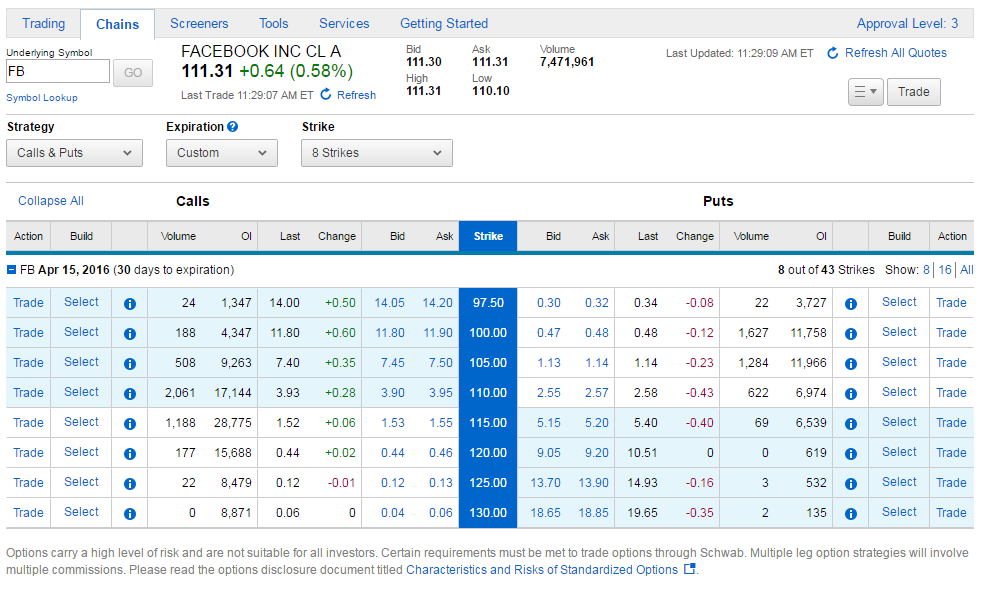

Sort of. You pick a company you think will go down, you pick a future date and then you open whats called an option chain. It looks like this:

The right side is puts (left is calls)

So in this example, Facebook was currently at 111, and you think it will go down to 100, so you go to that row and see that it costs you 0.48 to buy those puts (x100, options are sold in 100s).

Further to the right you see the volume, which is how busy that specific transaction is. If theres no volume, its probably a really bad idea, or youre a genius for being first.

Now at this point, puts arent selling for cents...some puts are going for $10+ dollars (x100) because of the market volatility. So its harder to get in at low risk.

And also there has to be a second step in there to actually make the money, yes you buy a put and the value of the put goes up, but how do you cash out without selling that put and therefore forcing yourself to buy those stocks?

or is the difference that you're not creating a new put to sell in this case, you're just passing it along to someone else? that's sell to close as opposed to selling a put?

I am selling the puts I bought to other people. So im not creating new puts, I am just passing them along. Think of it like hot potato.

Something happens at expiration (strike date) and it seems complicated so I am selling before we get to that date so I dont have to worry about it. Potentially Im losing some profit but its not worth the hassle to figure it out honestly.

On the website, you get these options:

Puts:

Buy to open

Sell to close

This is where you buy existing puts and then when youre ready you hand them off to someone else.

Puts:

Sell to open

Buy to close

This is when you create a new put, which is giving you an obligation to buy stock at expiration. If you buy to close, you are passing the potato along.

Shosta, is this all correct?